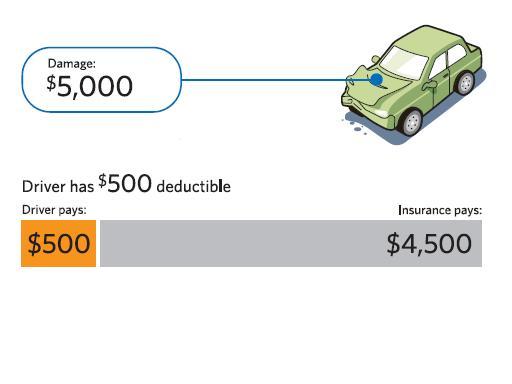

The insurance deductible is the amount of money you will pay for a claim before the insurance coverage starts paying up to the policy limits and conditions.

When buying insurance you are asking the insurance company to cover you if you suffer damages. The company says, "We will take care of the loss, but you agree to pay the first part (deductible)." You say, "Sure, I can afford the first $500 of any loss, if you can pay the rest."

Check out the example below.

As the person buying the insurance policy, you usually have the choice of how much your deductible will be.

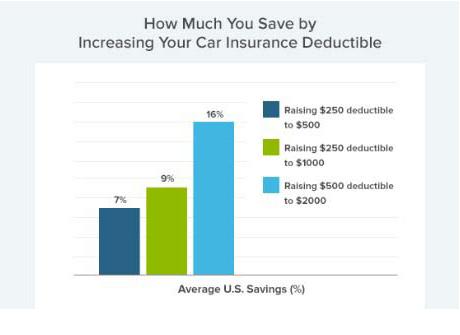

The higher the amount of risk you are willing to cover via the deductible, the less risk for the insurance company. Therefore, they reduce their cost. It's a partnership where you and the insurance company agree to share the financial risks.

Even though you pay more of the claim when you have a higher deductible, the reality is that people do not have claims every year. So every year that you do not have a claim, and took a higher deductible, you could be saving as much as 20% or 30% on your insurance costs.